In an era where time is of the essence, the demand for expedited services has permeated every aspect of daily life, including the realm of personal finance. Quick loan processing has emerged as a solution to meet the needs of individuals seeking fast access to funds for various purposes, ranging from unexpected expenses to urgent financial opportunities.

Streamlined Application Process:

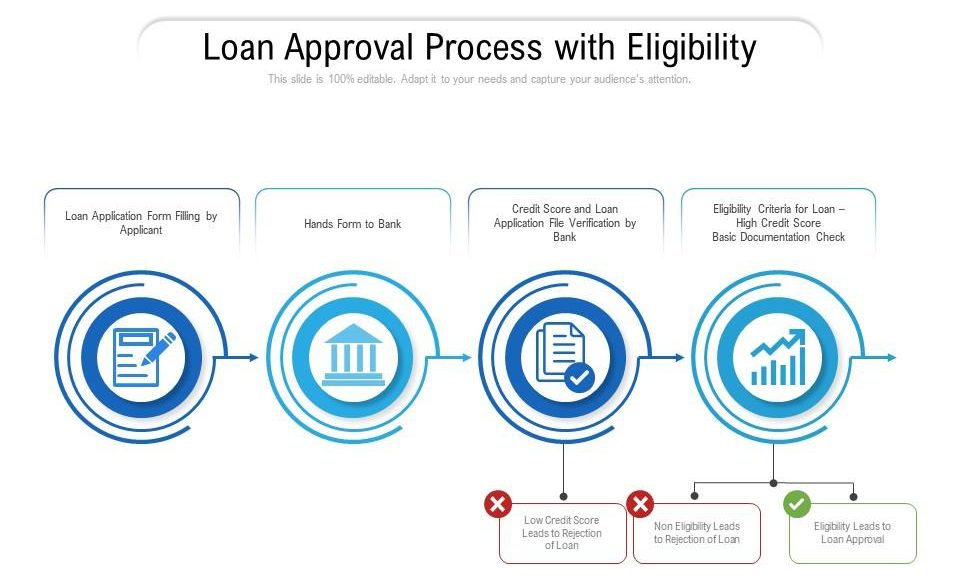

One of the key features of quick loan processing is its streamlined application process. Unlike traditional loans that may require extensive paperwork and documentation, quick loan providers often offer online applications that can be completed in a matter of minutes. This digital approach eliminates the need for in-person visits to banks or credit unions, allowing borrowers to apply for loans from the comfort of their own homes.

Rapid Approval and Funding:

Speed is the hallmark of quick loan processing, with many lenders boasting rapid approval and funding times. In some cases, borrowers can receive approval within hours of submitting their application, with funds deposited into their bank accounts the same day or within 24 hours. This swift turnaround time is particularly beneficial for individuals facing urgent financial needs or time-sensitive opportunities.

Minimal Eligibility Requirements:

Quick loan providers often have minimal eligibility requirements, making their services accessible to a wide range of borrowers. While traditional lenders may scrutinize credit scores, income stability, and collateral, quick loan providers may place less emphasis on these factors. Instead, they may focus on verifying basic information such as identity, employment status, and banking details.

Variety of Loan Options:

Despite their expedited nature, quick loan providers offer a variety of loan options to suit different financial needs and preferences. From short-term payday loans to installment loans with longer repayment terms, borrowers can choose the option that best aligns with their circumstances. Some lenders may even specialize in specific types of loans, such as personal loans or business loans.

Technology-driven Solutions:

The rise of quick loan processing can be attributed in part to advancements in technology. Online platforms and digital tools enable lenders to automate the application, verification, and approval processes, reducing the need for manual intervention and expediting loan processing times. Additionally, mobile apps and responsive websites make it easy for borrowers to access loan services anytime, anywhere.

Consumer Empowerment and Convenience:

Ultimately, quick loan processing empowers consumers by providing them with convenient access to financial resources when they need them most. Whether it’s covering unexpected medical expenses, consolidating high-interest debt, or seizing a time-sensitive opportunity, quick loans offer a lifeline for individuals navigating financial challenges. However, borrowers should exercise caution and carefully evaluate terms and conditions before committing to any loan agreement.